Inflation Chops Down Dollar Tree

Dollar Tree’s latest earnings report offers a grim reflection on the state of the American economy. What we are witnessing is not just a minor fluctuation in retail performance, but a broader indictment of an economy that, under the stewardship of Joe Biden and Kamala Harris, has manifestly lost its way.

For those unacquainted with Dollar Tree’s dual audience, its Family Dollar stores cater to lower-income households seeking everyday necessities, while its namesake brand draws in middle- and upper-income shoppers for affordable party supplies and seasonal goods. What makes this earnings report notable is the revelation that even households earning over $125,000 per year—once thought immune to such cutbacks—are now tightening their belts and shifting from “buying for want” to “buying for need.”

This is not a blip, nor should it be dismissed as a mere casualty of transient economic forces. Rather, it is the logical outcome of economic policies that have imposed inflationary burdens on all classes of Americans. The Biden-Harris administration, with its reckless fiscal expansions and ideological hubris, has forced consumers into a corner. It was inevitable that even the affluent would feel the blow; and now, with Dollar Tree’s stock plunging nearly 25 percent, the axe has finally bitten into the grain.

Dollar General Is Losing the Battle Against Inflation Too

The malaise is hardly confined to this one retailer. Dollar General, Dollar Tree’s main competitor, saw a similar fate recently, with its shares shedding one-third of their value. The discount chains—once considered havens during economic downturns—are now emblematic of something more troubling: the weakening of consumer confidence across the board. The administration has promised economic recovery, but these results suggest a fundamental fracture at the heart of their policies.

“Inflation has continued to negatively impact these households, with more than 60 percent claiming they have had to sacrifice on purchasing basic necessities due to the higher cost of those items,” Dollar General CEO Todd Vasos said on an analyst call.

Vasos pointed out that with customers paying more for expenses such as rent, utilities, and health care, there’s not much left over for retail goods.

The executives at Dollar Tree are clear-eyed about the situation. Mike Creedon, the company’s chief operating officer, remarked that the business is navigating through “one of the most challenging macro environments” in recent memory. No doubt. The retailer’s same-store sales grew a paltry 1.3 percent last quarter, far below the expectations of Wall Street, and Family Dollar’s sales dipped as well. Dollar Tree’s net income has fallen by one-third, a far cry from the 14 percent increase analysts were predicting. These numbers are not signs of poor management or shifting consumer tastes. They mostly reflect the economic reality under Biden and Harris.

Why is this happening? Because when inflation eats away at household budgets, even middle-class and wealthier families have to reconsider their spending. The people who used to shop at Dollar Tree for party favors are now skipping the party altogether.

If the Consumer Falters, So Does the Economy

The health of the consumer is particularly important at this moment because household spending has been one of the few sources of growth in the economy. In the second quarter, it contributed around two percentage points of the three percent growth rate. The manufacturing sector has contracted in 21 out of the the last 22 months, according to the Institute for Supply Management (ISM). As we were reminded in yesterday’s weaker than expected construction spending figures, the housing market is teetering on a recession despite sky-high prices. The labor market is weakening, as the larger-than-expected decline in job openings showed on Wednesday.

Closely linked to consumer spending is business inventories. Last quarter, the growth in inventories were responsible for roughly 80 basis points—or eight-tenths of a percentage point—of growth. But if the consumer is weakening, businesses are likely to find themselves with unwanted inventories. This would lead to even further weakness in the manufacturing sector as retailers pulled back from new orders, a process that the soft ISM and S&P Global purchasing managers survey reports for August suggest may already be underway.

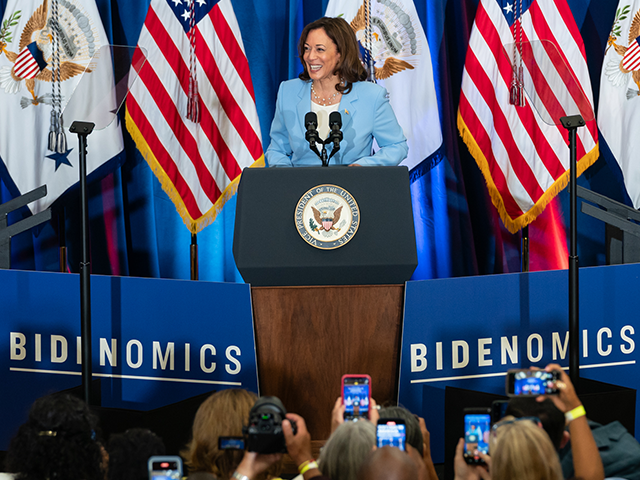

Vice President Kamala Harris delivers remarks on the one-year anniversary of the Inflation Reduction Act on August 15, 2023, in Seattle. (Official White House Photo by Polly Irungu via Flickr)

The Biden-Harris administration may continue to trumpet its economic successes, but the facts on the ground tell a different story. The American consumer is voting with their dollars, or rather with their lack thereof. And no amount of political posturing can obscure the reality that inflation has badly eroded the purchasing power of families across the country. The administration’s policies, driven by a combination of ill-considered fiscal expansion and an unending regulatory attack on business, have produced an environment in which even dollar stores struggle to maintain growth.

To watch Dollar Tree’s stock plunge is to watch, in real time, the unraveling of the economic mythology which Biden and Harris have been preaching for the past four years. The consumer economy, long thought to be resilient, is fraying under the weight of inflation and uncertainty. The middle class, once the engine of American prosperity, is now forced to cut back on even the simplest of purchases.

In the latest survey by YouGov for the Economist, taken between September 1 and 3, just 21 percent of the public said they think the economy is getting better, and just 14 percent said they are better off today than a year ago. Forty-eight percent said the economy is worsening and 43 percent said they are personally worse off.

This is not the robust recovery that Kamala Harris and Joe Biden tout on the campaign trail—it is the slow but steady erosion of confidence in their leadership.